Real Estate

Overview

Our Real Estate investment strategy offers strategic geographic diversification combined with a balanced tenant structure for our industrial properties. Through extensive experience and carefully selected transactions, we create attractive investment opportunities and mitigate risks. We provide stable returns based on secured future cash flows.

ARETE maintains a time-tested approach and focuses on value-add facilities in strategic Central and Western European countries near major transportation hubs and key distribution centres. New developments, managed internally by the Arete Group, offer value-creation opportunities through increased returns compared to acquisitions of fully completed assets.

400,000

Acquired

and in the Pipeline

310

million

AUM

12

STABILISED

Assets

Why ARETE for

Real Estate?

1

Premium Assets

Logistics and warehousing assets are part of the state critical infrastructure. The tenant portfolio comprises high-quality multinational manufacturing and logistics companies to ensure stable income and cash flow.

2

Professional Team

Our team of real estate experts and investment professionals has many years of international experience, and extensive industry know-how, and is an established player in several local markets.

3

Research-Based Approach

Comprehensive macroeconomic, market and sector-specific research provides crucial insights for capitalising on real estate market trends and supports risk-adjusted underwriting of investment opportunities.

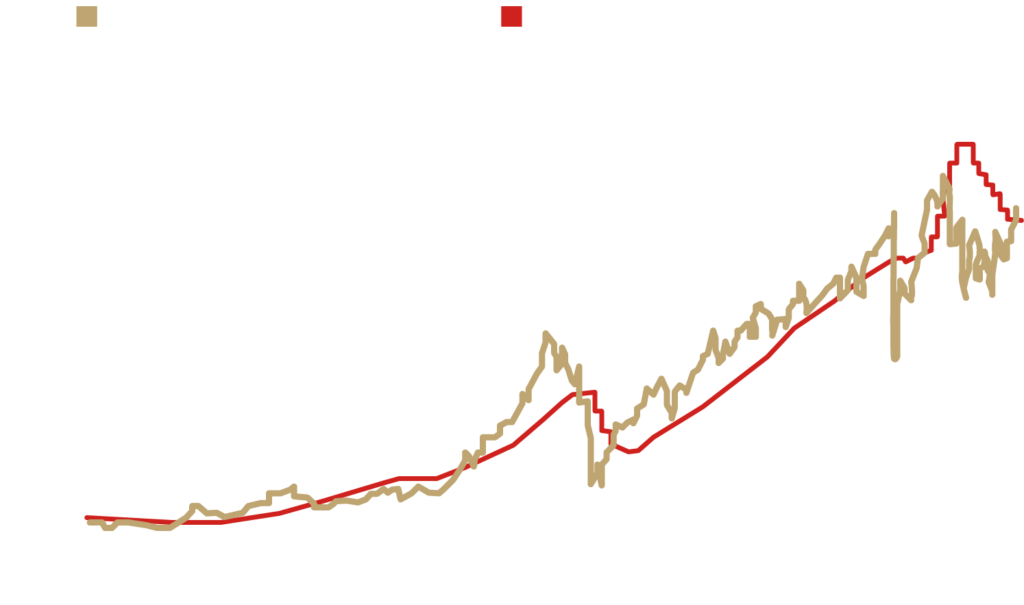

Public real estate valuations are trending upward while private ones are bottoming out providing a generational opportunity

Source: FTSE EPRA NAREIT Developed Total Return Index for listed, NCREIF Fund Index for Open-end Diversified Core Equities (reflects 28 institutional open-end commingled real estate funds). Bloomberg, UBS, September 2024

Investment Perspective

Industrial Real

Estate Portfolio

We focus on the acquisition and development of premium industrial properties with a "value-add" risk profile, which allows for easy re-leasing without the need for significant capital deployment after the expiry of the lease term.

Value Creation

Process

We focus on the long-term growth potential in asset value. Active management, including value enhancement strategies through improved property operations, plays an important role. Adhering to ambitious environmental regulations contributes to meeting ESG standards.

Strategic Asset

Positioning

To achieve optimal returns on invested capital, we focus on high-yield properties with stable income, as well as properties with further development potential for future tenant expansion.

Strategy Supported by Secular Tailwinds

Nearshoring Trend

Concerns over changes in the supply chain are driving businesses to relocate warehouses closer to their customers. This creates pronounced investment opportunities in Europe, particularly in the Czech Republic, Slovakia, Poland, and Germany.

E-commerce Expansion

We expect significant penetration of e-commerce and online sales over the next five years in Europe. The largest market growth is anticipated in emerging sectors such as the apparel industry, furniture, and food.

Real Economy Link

With the increasing complexity of supply chains, investments in logistics and industrial real estate have become key to maintaining economic stability and security with tangible environmental and social impacts.

Market Stability

Industrial real estate preserves its value over time and combines several key factors: it has historically demonstrated a low correlation with traditional asset classes, an integral part of core business functions, and socio-economic changes in society work in its favour.

ARETE offers a niche approach to industrial real estate and exclusive investment solutions to our clients. Our team of investment professionals has been tested through market cycles. We cherry-pick assets and invest in stable industrial properties with an attractive long-term profile and a balanced risk-return ratio. Our disciplined approach to value creation sets us apart from other asset managers.

How We Invest

Demonstrating our successful track record: in 2017, we closed the arete INVEST Sub-fund CEE fund, followed by the ARETE INVEST Sub-fund CEE II fund in 2021, both of which delivered above-average returns. We closely monitor real estate market trends and leverage our knowledge of the local environment to identify high-quality industrial properties. The ARETE INDUSTRIAL FUND is classified as a “light green” product under Article 8 of the SFDR, related to sustainability disclosures in the financial services sector.

Our Portfolio

With a longstanding history of acquiring, constructing and operating assets in diverse European markets, ARETE leverages its heritage and footprint to invest in resilient real estate. Our thematic approach allows us to pursue an attractive risk-return profile while unlocking opportunities wherever we find them.

Related Content

News, articles, and information for investors.