Slovensko is Singapur in central Europe

Sam Shergill, privátny investor a člen správnej rady investičného fondu Arete Invest, pre Hospodárske noviny. http://finweb.hnonline.sk/financie-a-burzy/1011102-slovensko-je-singapur-v-strednej-europe

Bedřich Skalický joins Arete board of investors

Bedřich Skalický joined Arete Invest’s investment board. Skalický works for Deloitte, where he is in charge of transactions and property investment. He is also serves as president of the Czech Chamber of Real Estate Agencies and is a member of the Czech Chamber of Architects. http://cijeurope.com/en/encompassme-europe/26896/story/bedrich-skalicky-joins-arete-board-of-investors

Bedřich Skalický becomes a new member of the Investment Committee of Arete Invest

the Investment Committee of the Arete Invest Real Estate Fund welcomed a new expert in real estate and investment, Bedřich Skalický, in August. Bedřich Skalický also works in Deloitte, where he is responsible for transactions and investment in real estate. Bedřich has over 24 years of experience in real estate and investment. He is the President of the Czech Chamber of Real Estate Companies and a member of the Czech Chamber of Architects. He has experience in business and investment consulting in the field of real estate and funds. He worked for Česká spořitelna (Erste Group), where he founded a new real estate subsidiary and two real estate funds owned by Česká spořitelna (CSIA, CSSG) with assets totaling CZK 10 billion. He began his professional career in real estate with McDonalds as a real estate manager. Bedřich completed his studies in economics in Prague and at the University of Boston. He speaks Czech, English and Russian.

Slovak RE investment volume worth to hit €600m in 2017

The real estate investment volume for 2017 is expected to hit €600m in 2017, down from €850m in 2016, according to JLL. A mere 154 million EUR in real estate deals were transacted in the first six months of the year, with an additional 350 million EUR in progress. http://cijeurope.com/en/encompassme-europe/26764/story/slovak-re-investment-volume-worth-to-hit-600m-in-2017

Revenue and risk are like two sides of one coin. What do bonds, stocks, currencies and realities offer today?

An overview of the current investment environment in terms of returns and risk with a slight emphasis on the real estate market was offered at the Investment Forum in Prague by Robert Ides from ARETE INVEST. http://www.investicniweb.cz/video-vynosy-a-riziko-jsou-jako-rub-a-lic-mince-co-dnes-nabizeji-dluhopisy-akcie-meny-a-reality/

Arete Invest won the Czech Top 100 award

Arete Invest, a rapidly growing real estate investment fund, won the prestigious Czech Top 100 – Special Award for Innovation and Transparency in the Czech Republic's Investment Market during a gala evening in the Spanish Hall of Prague Castle. http://kancelarie.etrend.sk/novinky/arete-invest-ziskal-cenu-czech-top-100

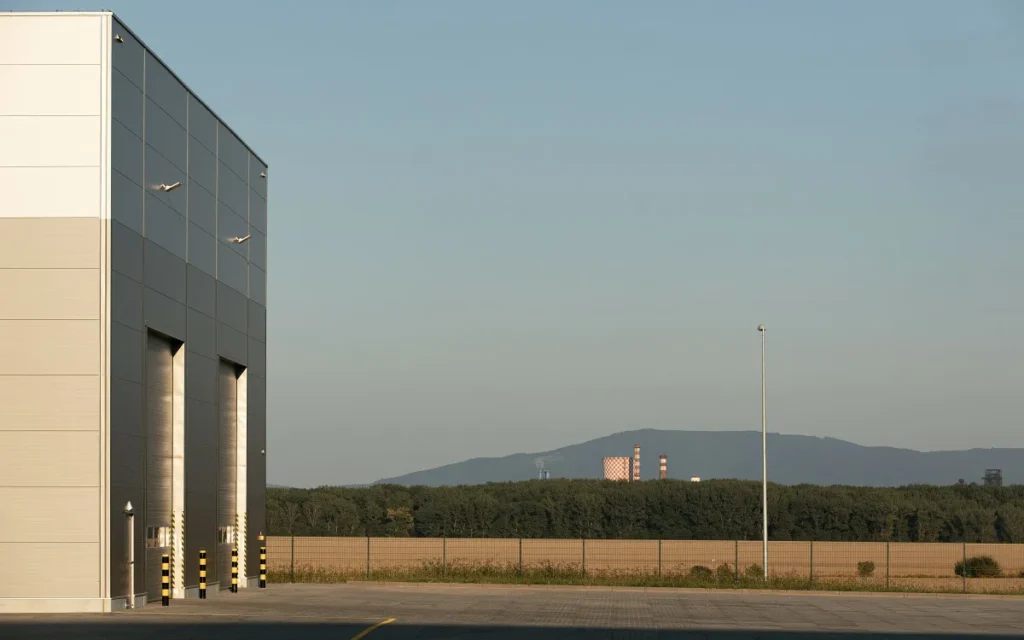

Arete Invest has started restructuring its complex in Nové Mesto nad Váhom

The Arete Invest Real Estate Fund has started the long-planned restructuring of its industrial and logistics complex ARETE PARK NOVÉ MESTO in Slovakia. In the first stage, it will introduce 19,000 m2 of warehouse space to the market. In the second stage, it is planning the construction of new capacities with a floor area of up to 30,000 m2. “ We want to find new tenants for one of the existing halls. Our financial models figure in an increase in the revenues from leasing and a risk diversification in the form of smaller lease units. We want to take advantage of the trend of a high year-on-year growth of the prices for leasing logistics premises, which is approximately 10 % year-on-year in Slovakia. We have already purchased a complex with this plan,” says Tomáš Novotný, Head of Asset Management at Arete Invest. According to him, the demand for warehouse and production space has been steadily growing in Slovakia. In addition to the growth in rent, this is manifested also in a very high occupancy rate of leasable space (only 2.3 % is available). Furthermore, demand exceeds supply by more than double in the microregion of Nové Mesto nad Váhom. “The part of restructuring is also a negotiation on prolongation of a lease agreement with current major tenant of the complex, C&A clothing chain. Given the boom in the Slovak market, which is currently more attractive than the Czech market to real estate investors, we expect an increase in the revenues from leasing. Therefore, this step should be good news for our investors. We will commence the construction of new capacities depending on the current demand,” concludes Tomáš Novotný.

Arete Invest has started restructuring its complex in Nové Mesto nad Váhom

The Arete Invest Real Estate Fund has started the long-planned restructuring of its industrial and logistics complex ARETE PARK NOVÉ MESTO in Slovakia. In the first stage, it will introduce 19,000 m2 of warehouse space to the market. In the second stage, it is planning the construction of new capacities with a floor area of up to 30,000 m2. “We want to find new tenants for one of the existing halls. Our financial models figure in an increase in the revenues from leasing and a risk diversification in the form of smaller lease units. We want to take advantage of the trend of a high year-on-year growth of the prices for leasing logistics premises, which is approximately 10 % year-on-year in Slovakia. We have already purchased a complex with this plan,” says Tomáš Novotný, Head of Asset Management at Arete Invest. According to him, the demand for warehouse and production space has been steadily growing in Slovakia. In addition to the growth in rent, this is manifested also in a very high occupancy rate of leasable space (only 2.3 % is available). Furthermore, demand exceeds supply by more than double in the microregion of Nové Mesto nad Váhom. “The part of restructuring is also a negotiation on prolongation of a lease agreement with current major tenant of the complex, C&A clothing chain. Given the boom in the Slovak market, which is currently more attractive than the Czech market to real estate investors, we expect an increase in the revenues from leasing. Therefore, this step should be good news for our investors. We will commence the construction of new capacities depending on the current demand,” concludes Tomáš Novotný.

The Czech Top 100 Association grants a special award for innovation and transparency in the investment market to Arete Invest

Arete Invest, a fast-growing fund focused on investment in real estate, received the prestigious Czech Top 100 Award – a special award for innovation and transparency in the Czech investment market – at a ceremony in the Spanish Hall of the Prague Castle at the end of June. The reasons why Czech Top 100 granted the special award were in particular the fund’s successful efforts to bring foreign capital to the Czech Republic, its very transparent approach to investors ,in which it holds up international standards, (albeit under the supervision of the Czech National Bank due to the fund’s local registration), the regular quarterly distribution of dividends in the amount of 6 % per year and a short investment cycle of the first sub-fund with the audited result of more than 100 % of profit for shareholders for a mere 18 months. “Over several years of operation, we have achieved numerous successes and caught up with the largest Czech companies. Our transparency towards our investors is one of our key principles – we are, therefore, truly proud of the award we have received. We believe that we will continue to bring the same above-standard revenues to our investors,” says Lubor Svoboda, co-founder and Chairman of the Management Board of Arete Invest. Arete Invest already has a second active sub-fund; the investment story of the first sub-fund ended last year by selling off the entire residential portfolio consisting of several hundred housing units to a foreign financial investor. In February 2016, the second sub-fund of Arete Invest, CEE II, was established. This sub-fund is gradually creating a homogeneous portfolio of high-standard revenue-bearing industrial real estate. The expected value of the assets managed by CEE II over the anticipated five-year investment cycle is 200 million euros. The sub-fund aims at the continuous improvement of the investors’ funds in the amount of 11-16 % per year, of which up to 6 % per year are regular dividends paid on a quarterly basis. However, as can be seen in the audited results for 2016, the current revenue rate far exceeds the 16 % announced – the gross revenue for the last year was as much as 25.7 %. By the end of this year, the fund is planning to invest another 60 million euros in the Czech and Slovak markets and thereby shift the volume of the assets owned to the threshold of approximately 120 million euros

The Czech Top 100 Association awarded a special prize for innovation and transparency on the investment market of Arete Invest

Arete Invest, a fast-growing real estate investment fund, won the prestigious Czech Top 100 Prize for Innovation and Transparency in the Czech Republic’s Investment Market at the end of June at the Prague Hall of the Prague Castle. http://www.finparada.cz/zprava_banka.aspx?ID=14052