CIJ Awards 2018

At the annually announced prestigious CIJ Awards 2018, the founders of Arete Invest took over the Best Performance Fund Manager prize. CIJ Awards is the most important event in commercial real estate evaluation in the Czech Republic, this year the 18th edition was held.

The owner of ARETE Park Nové Mesto became the most high-performance real estate fund for big investors

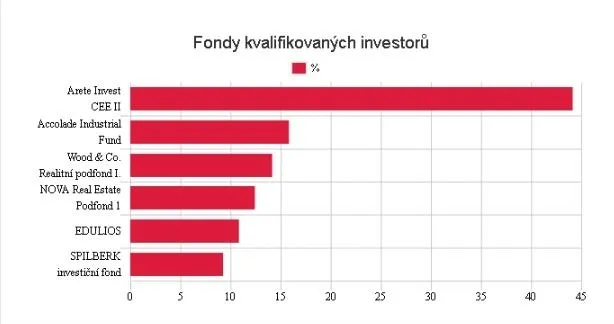

Arete Invest, a fast-growing Czech fund focused that is also active in Slovakia, has become the most high-performance fund for qualified investors. The owner of Arete Park in Nové Mesto nad Váhom succeeded in the evaluation of Czech real estate funds, which was jointly prepared by Hospodářské noviny and the Institute of Strategic Investments at the Faculty of Finance and Accounting at the University of Economics in Prague. The performance of Arete Invest CEE II, which was determined as a change in the net asset value per share or unit certificate, reached 44.15 % last year. For comparison, the second highest-ranking fund for qualified investors (i.e. those who have at least one million Czech crowns, or about 39,000 euros) reached 15.83 percent. “This result is proof of a well-chosen strategy and the right selection of investment opportunities,” says Lubor Svoboda, co-founder of Arete Invest. This year, Arete Invest began the construction of a new hall in its industrial and logistics complex in Nové Mesto nad Váhom, which is part of the award-winning sub-fund Arete Invest CEE II. The investments in the new central warehouse for the Central and Eastern Europe Region for the Factcool group, an international network of online fashion stores, will reach 11 million euros. In it, jobs will be create for more than 100 people. The new warehouse will be commissioned in April 2019, and it will offer a storage area of more than 60,000 m2 on an area of 16,500 m2 thanks to a multi-level storage system. At the same time, preparations for the further expansion of the Nové Mesto complex by approximately 31,000 m2 are under way. “In addition to the excellent returns, our focus on industrial real estate and logistics parks is also less prone to any fluctuations in the economic cycle and thus gives our investors excellent prospects in the years to come,” says Lubor Svoboda, while explaining that the right set-up of the fund is also confirmed by the victory of Arete Invest in the Best Performing Fund Manager category, which was won by the fund during the announcement of the CIJ Awards 2018. “In Slovakia, we still see great potential for development. Demand for storage and production space is steadily increasing. This is reflected not only in the rising rents, but also in the very low non-occupancy of leasable spaces of just 4 percent. In the micro-region of Nové Mesto nad Váhom, it is actually only around one percent,” says Lubor Svoboda in conclusion. About Arete Invest: Arete Invest is a fast-growing investment fund focused on investment in real estate and a holder of the prestigious Czech Top 100 Award for innovation and transparency in the Czech investment market. It is a fully licensed Czech fund of qualified investors in the legal form of SICAV and operating under the supervision of the Czech National Bank. Arete Invest is a proactive manager of both funds and assets. The primary objective of the fund is to increase revenue and improve capital in the case of assets under its own management while ensuring diversification against both existing and potential risks. As a result, it offers its investors an appreciation of investments that is above the average by a significant margin. It adheres to five basic principles – its expertise, active management, the tangibility of investments, simplicity and a transparent approach towards its clients. Arete Invest focuses primarily on medium and large investments in conventional revenue-bearing real estate in the Czech Republic and the regions of Central and Eastern Europe. For more information, please visit:

A new portal on ihned.cz was launched

A new project of Hospodarske Noviny was launched, a website www.ihned.cz/investujme, which provides an overview of investment opportunities in the Czech Republic. The official launch of the portal was accompanied by a round table discussion attended by Robert Ides as a representative of Arete Invest. We are very proud and pleased to see Arete Invest as the best profitable fund of qualified investors in the Czech Republic in the independent ranking. A new project of Hospodarske Noviny was launched, a website www.ihned.cz/investujme, which provides an overview of investment opportunities in the Czech Republic. The official launch of the portal was accompanied by a round table discussion attended by Robert Ides as a representative of Arete Invest. We are very proud and pleased to see Arete Invest as the best profitable fund of qualified investors in the Czech Republic in the independent ranking.

Arete Park Nové Mesto is expanding; the fund is investing 11 million EUR into it

Arete Invest, the fast-growing Czech fund specialising in property investments, launched the construction of another hall at its Slovak industrial and logistics site in Nové Mesto nad Váhom in July. Its investment into the new central warehouse for Central and Eastern Europe for the Factcool group, an international chain of internet fashion shops, amounts to 11 million EUR. It will provide jobs for more than 100 people. The new warehouse will be opened in April next year and, covering an area of 16 500 m2, will offer over 60 000 m2 of storage space due to its multi-level storage system. Preparations are also under way to further expand the Nové Mesto site. “For our fund and our investors, who expect above-standard yields, the Slovak market is a favourable investment destination. Besides expanding the Arete Park Nové Mesto, we are also negotiating concerning the construction of two completely new sites worth 15 million EUR and are planning further acquisitions here, too,” said Lubor Svoboda, co-founder and chairman of the Arete Invest fund management board. “Our agreement with the Factcool group confirms the strategic position of Arete Park Nové Mesto nad Váhom. Factcool will be operating from this highly important site for a minimum of ten years. We are glad to be able to support the growth of the group,” said Tomáš Novotný, member of the Arete Invest investment committee responsible for asset management. “Talks are also under way with other tenants who could occupy the remaining vacant construction plots next year, thus enabling us to increase our current high investment of 11 million EUR.” The construction of the new Factcool central warehouse for the region of Central and Eastern Europe will commence in July. The new warehouse will open in April next year and, covering an area of 16 500 m2, will offer over 60 000 m2 of storage space thanks to its fully automated multi-level storage system. The lease contract has been concluded for 10 years from the completion of the hall. The new tenant will thus create more than 100 jobs in the park. The Arete Invest fund purchased the site in Nové Mesto nad Váhom from Prologis last year. In terms of the size of the investment the deal was one of the biggest real estate transactions in the industrial sector in Slovakia last year. The completed part of the site is 100% leased to the companies C&A, Raben Logistics and Vetropak Nemšová, with an average lease length of 5.3 years, a unique figure in what is a purely logistics area. Demand for storage and production premises is rising steadily in Slovakia. Besides the increase in rent prices, this is also apparent in the very low vacancy rates in leasable premises, currently at a mere four percent, and as low as approximately one percent in the Nové Mesto nad Váhom microregion. Besides its existing work, Arete Invest is preparing to further expand its Arete Park by approximately 31 000 m2. The aim of the Arete Invest fund is to actively manage all the properties in its portfolio and also to increase their value, through expanding tenants, extending lease contracts, strengthening relations with tenants and using previously vacant land for future construction projects. The Nové Mesto site is part of the portfolio of the currently open Arete Invest CEE II sub-fund. The estimated value of the assets managed by this sub-fund during the anticipated five-year investment cycle is 200 million EUR. The sub-fund strives to ensure that investors’ funds enjoy an appreciation rate of up to 11 % per year, while as much as 6 % per year comprises money paid out on a quarterly basis. Current profitability far exceeds these stated figures.

Arete Invest will build a new warehouse in Slovakia for growing online brand

A local Real Estate Fund Arete Invest will build an international warehouse for Factcool e-shop in Slovakia in Nové Mesto nad Váhom. E-commerce investors of Factcool is Ivan Chrenko, who also owns the developer group HB Reavis. The investment in the construction of the new warehouse complex will reach a quarter billion crowns. Factcool is on the market for less than four years, with sales of 1 billion crowns now. https://www.skladuj.cz/arete-invest-vybuduje-na-slovensku-novy-sklad-rostouci-on-line-znacky-2370

The Arete Real Estate Fund will build a new warehouse in Nove Mesto nad Vahom.

The contract will be executed for the Factcool international internet store and the warehouse will serve the whole Central and Eastern Europe. Chairman of Administrative Board of Arete Invest Lubor Svoboda informed that on the total area of 15,500 square meters, the building will offer a storage facility in several levels of more than 60,000 square meters of warehouse space. https://www.investujeme.sk/kratke-spravy/realitny-fond-arete-postavi-novy-sklad-v-novom-meste-nad-vahom/

Czechs want to invest more than 26 million in Nove Mesto nad Váhom. It will create hundreds of new jobs

The Czech investment fund has only recently entered the Slovak market and is gradually expanding. In a year and a half, the industrial park near Zilina, neighboring Kia, was bought for 4.7 million euros and the purchase of industrial and logistics park Prologis in Nove Mesto nad Váhom was among the largest real estate business transactions in Slovakia in 2017 . https://www.forbes.sk/cesi-chcu-v-novom-meste-nad-vahom-investovat-vyse-26-milionov-pribudnu-stovky-pracovnych-miest/#

The Czechs will build a European e-shop store of clothing

Right next to the European distribution center of the C & A chain, the Czech Fund Arete Invest will build an international warehouse of fast-growing e-shop with fashion. One of the e-shop owner is one of the richest Slovaks with his business in the Czech Republic. https://www.e15.cz/byznys/reality-a-stavebnictvi/cesi-postavi-evropsky-sklad-e-shopu-s-oblecenim-

Forschner in Hradiště extended the lease contract by 11 years, expands production

Arete Invest signed a new five-year lease agreement with the Fiege logistics company in March. The company will increase its storage capacities of Lovosice Park area by 7500 m2 to the total of 9600 m2 already in April. Cushman & Wakefield and 108 Agency were the lease consultants in this case. Arete Invest is also planning to expand the area by another 11,000 m2 of warehouse and production area. https://archiv.ihned.cz/c1-66179610-news https://www.buildingnews.cz/investicni-trh/arete-invest-chysta-rozsireni-lovosickeho-prumysloveho-parku.html

The Arete Invest Fund invests almost 3 million in the expansion of the premises in Uherske Hradiste, the lease contract with the tenant extended by 11 years

Arete Invest, a fast-growing Czech real estate investment fund, signed a new lease agreement with Forschner in May, which is valid until 2029. Forschner's production capacity in the Uherske Hradiste Park Area will thus be expanding by another 5,000 m2 to 12,300 m2 next year. The total investment in new construction is estimated at 75 million crowns (roughly 2.9 million euros). “We are glad we can support the further development of our tenant. Thanks to the expansion of the premises in Uherske Hradiste and a significant extension of the contract, we are further stabilizing and increasing the value of our Sub-Fund's portfolio, “said Tomáš Novotný, Investment Fund member of the Arete Invest CEE II Sub-Fund, responsible for asset management. http://www.informuje.com/mediamedia/fond-arete-invest-investuje-takmer-3-miliony-do-rozsirenia-arealu-v-uherskom-hradisti-s-n